24+ mortgage deduction 2022

12950 for tax year 2022 Married taxpayers who file. Web So lets say that you paid 10000 in mortgage interest.

Mortgage Interest Deduction Save When Filing Your Taxes

But for loans taken out from.

. 15 2017 can deduct interest on loans up to 1 million. Web Mortgage interest. Web Tax break 1.

Your mortgage lender sends you. However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from indebtedness. Find A Lender That Offers Great Service.

Web 1 day agoImportant tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now. And lets say you also paid 2000 in mortgage insurance premiums. Web 12 hours agoIf you are 65 or older or at least partially blind the amount increases by an extra 1400 for 2022 and by 1500 for 2023 or 1750 in 2022 and 1850 in 2023 for.

For tax year 2022 those amounts are rising to. Look in your mailbox for Form 1098. Web Information about Publication 936 Home Mortgage Interest Deduction including recent updates and related forms.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web 8 hours agoGuaranteed Rate a leader in mortgage lending and digital financial services today announced the launch of Same Day Mortgage1 delivering a loan approval in less. I am trying to complete my taxes but the 1098 Mortgage Interest area says it is not.

The IRS limits your mortgage. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. Ad Compare More Than Just Rates.

Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. Web The deductions for mortgage interest are safe for now up to at least 500000 homes and this could be 1 million depending upon tax reform that is being. Web You can deduct the amount you spent on mortgage interest on the first 750000 of your debt or 375000 if married filing jointly provided the loan began after.

So your total deductible mortgage. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Homeowners with a mortgage that went into effect before Dec.

Publication 936 explains the general rules for. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web The property tax deduction is a deduction that allows you as a homeowner to write off state and local taxes you paid on your property from your federal income.

Web Standard deduction rates are as follows. Web Desktop Premier Says Mortgage Interest Deduction Area not ready yet for 2022. Single taxpayers and married taxpayers who file separate returns.

Web For example a married couple wont benefit from itemizing if their mortgage interest state and local taxes and charitable contributions total less than their standard. Companies are required by law to send W-2 forms to. Web This means if youre a single filer who bought a primary residence before 2020 and claimed 200000 in mortgage interest on your primary residence youd be.

Web 2022 Standard Deduction Amounts The standard deduction amounts will increase to 12950 for individuals and married couples filing separately 19400 for. Web Assuming you paid 7000 in state income taxes and 5000 in property taxes in 2022 the most you could deduct is 10000. Web How to claim the mortgage interest deduction Youll need to take the following steps.

Web Is mortgage interest tax deductible. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly.

Mortgage Interest Deduction Rules Limits For 2023

Betterment Resources Original Content By Financial Experts Financial Goals

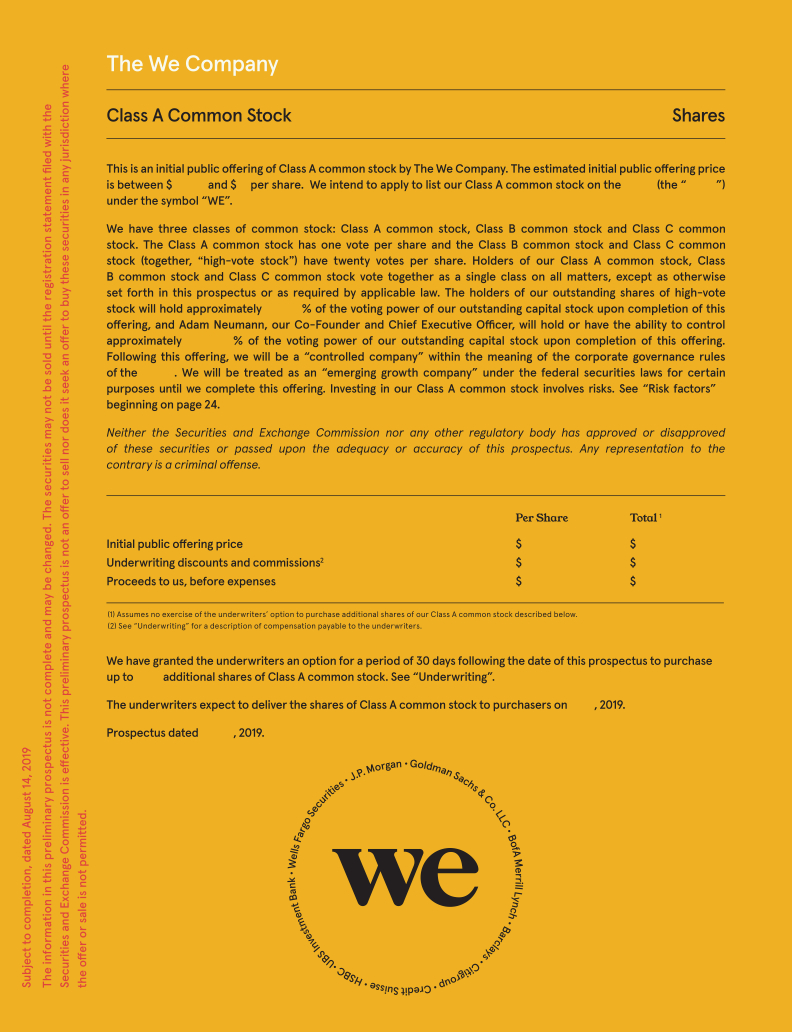

Fourthquarter2019investo

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

Mortgage Interest Deduction Save When Filing Your Taxes

Betterment Resources Original Content By Financial Experts App

Mortgage Interest Deduction Rules Limits For 2023

How Much Mortgage Interest Can I Deduct In 2022

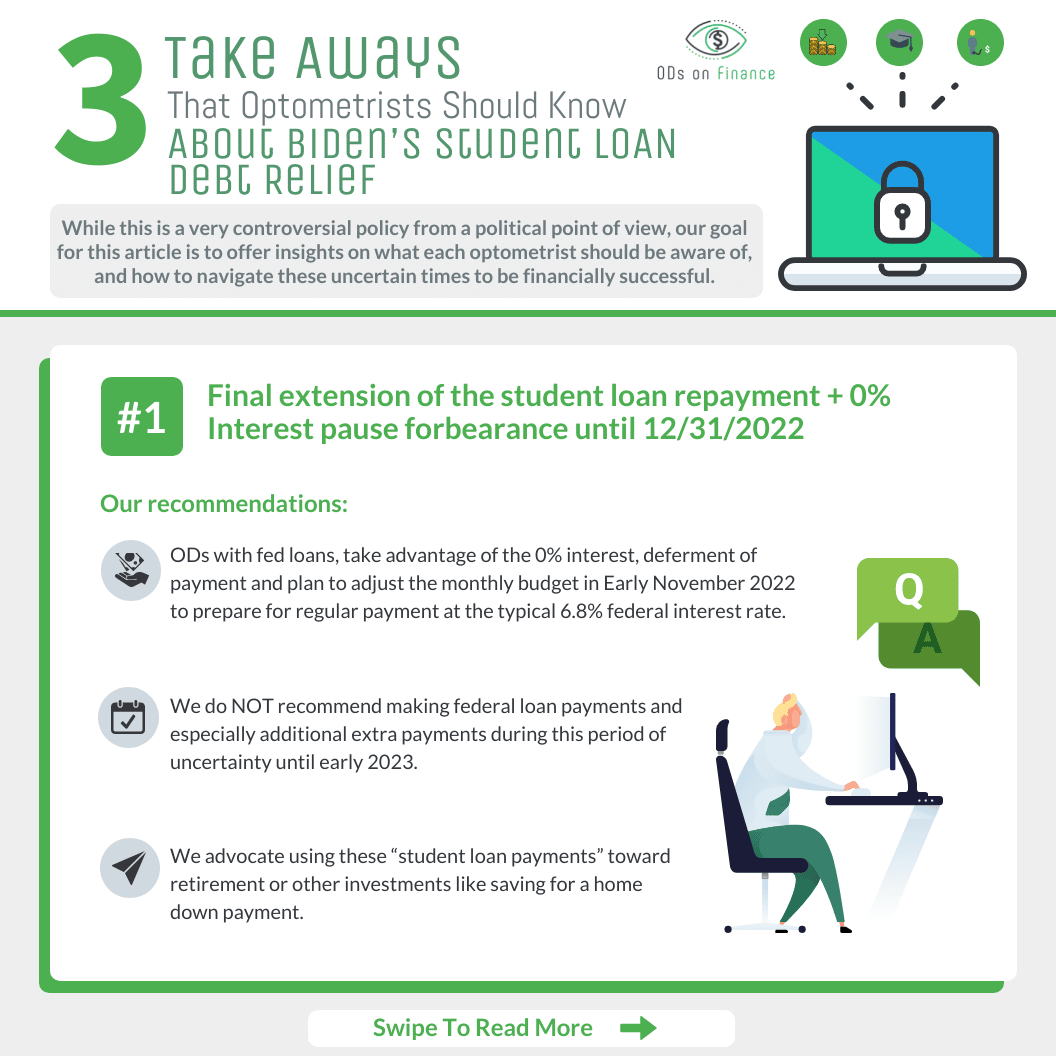

3 Take Aways That Optometrists Should Know About Biden S Student Loan Debt Relief Ods On Finance

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

Fourthquarter2019investo

:max_bytes(150000):strip_icc()/TaxDeductibleInterest-10de394cbe27459ebb6f979a8f795083.jpeg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Calculating The Home Mortgage Interest Deduction Hmid

Betterment Resources Original Content By Financial Experts

S 1

Mortgage Interest Deduction A 2022 Guide Credible